Common Reporting Standard Malaysia

This is known as the common reporting standard.

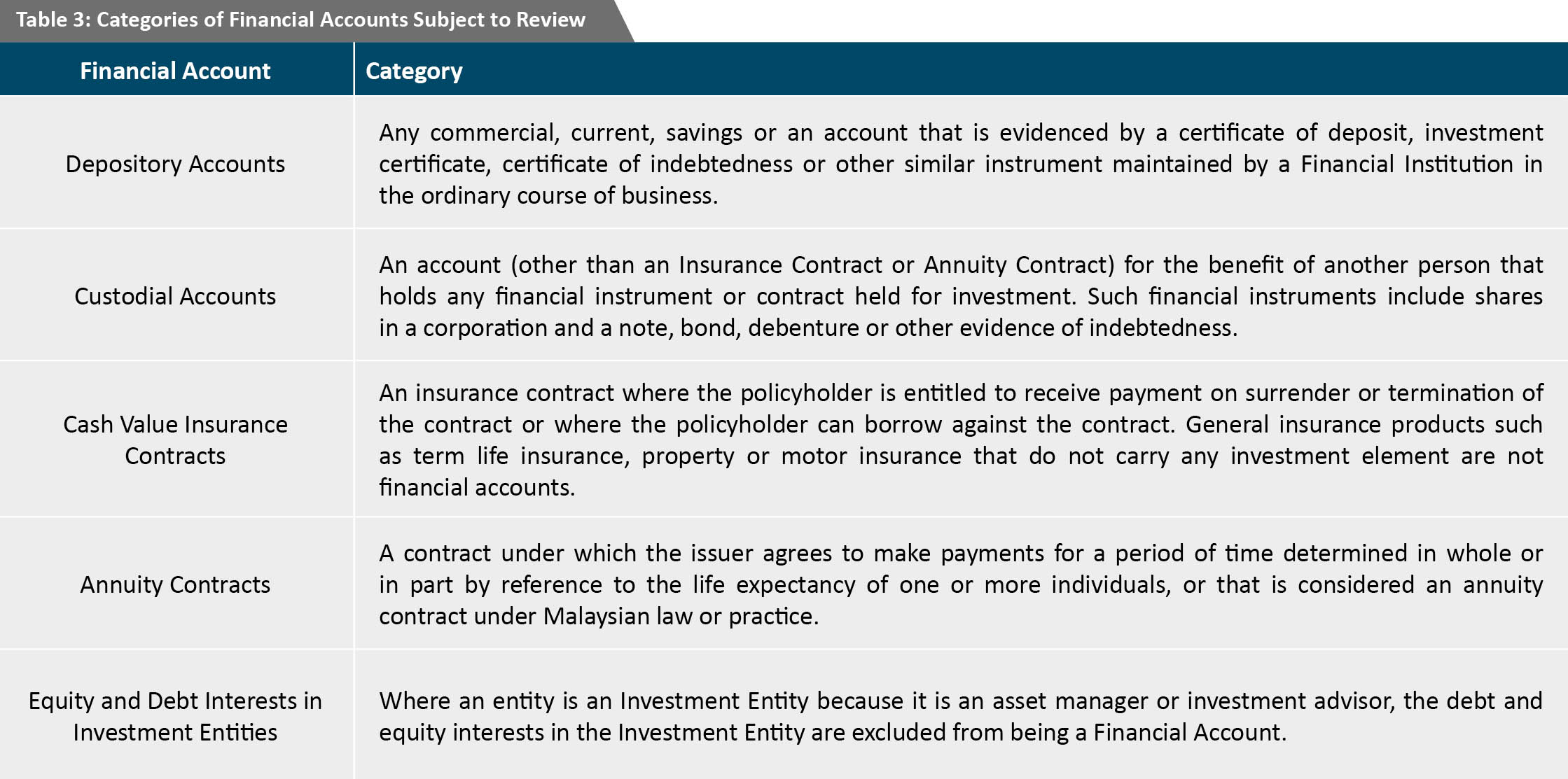

Common reporting standard malaysia. Malaysia has committed to exchange the crs information from 2018 and would also be receiving financial account information on malaysian residents from other countries tax authorities. Its purpose is to combat tax evasion the idea was based on the us foreign account tax compliance act fatca. Common reporting standard crs is a global standard for automatic exchange of information aeoi on financial account information between the governments in order to combat offshore tax evasion and protect the integrity of taxation systems. Reporting obligations under the common reporting standard crs.

B clarify the options which malaysia has adopted in respect to the crs implementation. To help fight against tax evasion and protect the integrity of tax systems governments around the world are introducing a new information gathering and reporting requirement for financial institutions. Common reporting standard crs the crs consists of global tax reporting requirements that have been introduced in malaysia effectively from 1 july 2017 with an aim to reduce tax evasion by tax residents of each participating parties. The crs was developed by the organisation for economic development and cooperation oecd to put a global model of automatic exchange of information into practice.

The common reporting standards crs aims to enable tax authorities to tackle offshore tax evasion by providing a greater level of information on their residents wealth held abroad. As a party to the convention on mutual administrative assistance in tax matters malaysia already has laws in place to ensure the strict compliance and enforcement of crs. Over 100 countries jurisdictions including malaysia have committed to crs. The common reporting standards crs aims to enable tax authorities to tackle offshore tax evasion by providing a greater level of information on their residents wealth held abroad.

Home common reporting standard crs. Common reporting standard crs for the automatic exchange of financial account information. As a party to the convention on mutual administrative assistance in tax matters malaysia already has laws in place to ensure the strict compliance and enforcement of. Common reporting standard crs is a global standard for automatic exchange of information aeoi on financial account information between the governments in order to combat offshore tax evasion and protect the integrity of taxation systems.

Over 100 countries jurisdictions including malaysia have committed to crs.