Gst Refund Malaysia For Business

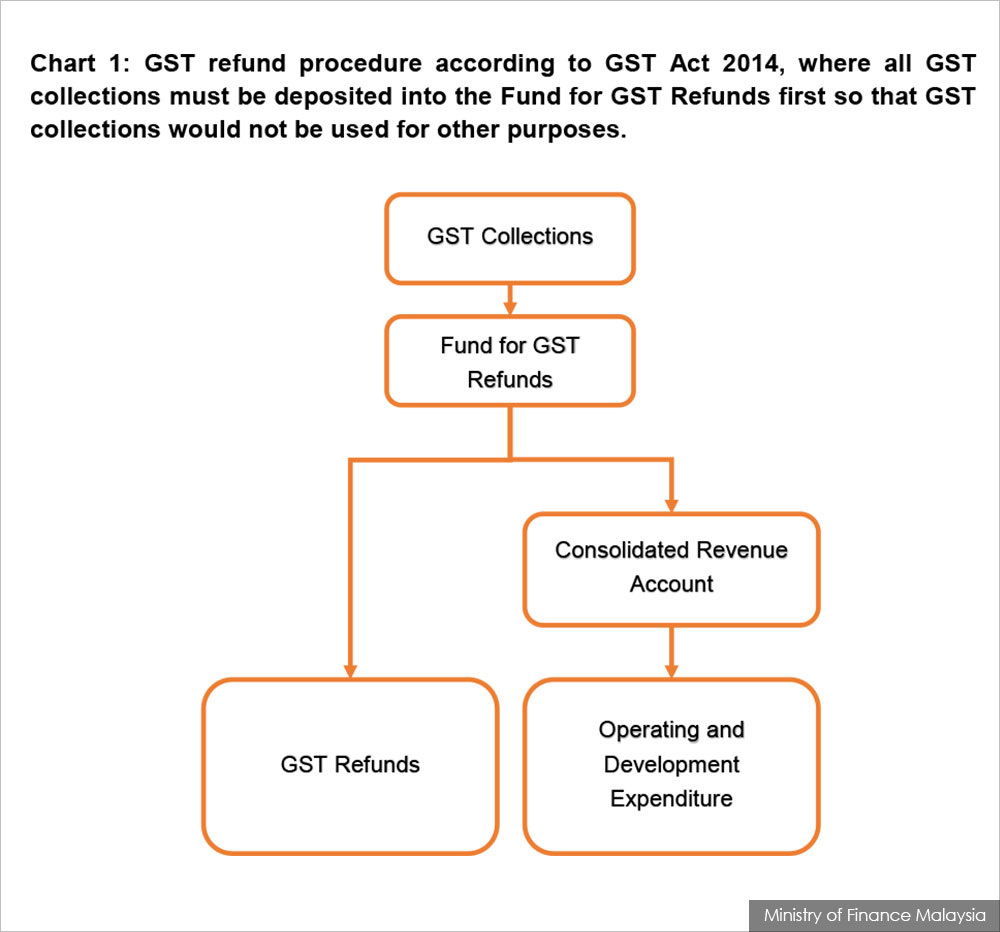

To me money can only be robbed if it is siphoned out of the cf without.

Gst refund malaysia for business. Malaysia productivity corporation mpc director general datuk. You must claim the gst refund within 2 years of the relevant date of the refund application. If the refund amounts are significant any delay may cause inconvenience and disruption to business operations. Some even said it was robbed.

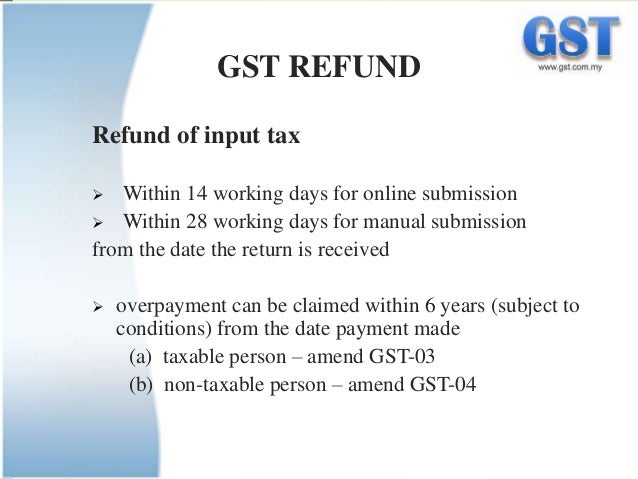

Once you find yourself eligible to file a claim for gst refund you will need to file your claim through gst refund form rfd 01. Refund will be made to the claimant within 14 working days if the claim is submitted online or 28 working days if the claim is submitted manually. Refund will be made to the claimant within 14 working days if the claim is submitted online or 28 working days if the claim is submitted manually. Any refund of tax may be offset against other unpaid gst customs and excise duties.

The cbic issued a set of clarifications in view of certain challenges being faced by taxpayers in adhering to the compliance requirements following the coronavirus outbreak. Read more about businesses can claim gst refund for services goods contract cancellations on business standard. Lim had earlier said the refund will be paid starting next year. Who is entitled to claim input credit under gst.

Finance minister tengku datuk seri zafrul abdul aziz said the gst refund payment process would be completed by december this year. Kuala lumpur june 19 goods and services tax gst refund claimants are advised to update their particulars in the taxpayers access point tap to enable the royal malaysian customs department to facilitate the repayment process. Concisely itc is gst paid or payable by a registered person on the purchases or expenses incurred for the business activities. Organisations like federation of manufacturers malaysia fmm has urged the government not to offset gst refunds owed to companies with sst payments that they are required to make to the government.

Any refund of tax may be offset against other unpaid gst customs and excise duties. A certified chartered accountant should preferably prepare the form. Additional cost of borrowings may also be incurred by companies as they need to seek an alternate source of finance while waiting for the delayed gst refund. In malaysia a person is eligible to claim input tax refund if he or she is making a taxable supply and fulfils criteria as follows.

How to claim refund on gst.