Personal Tax Rate 2017 Malaysia

Melayu malay 简体中文 chinese simplified malaysia personal income tax rate.

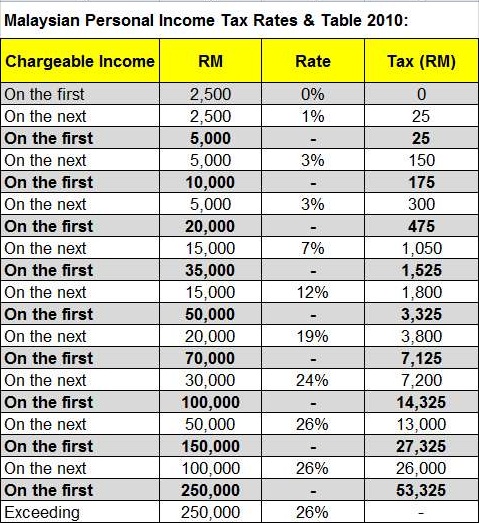

Personal tax rate 2017 malaysia. If you find this to be too much mathematics for you. For expatriates that qualify for tax residency malaysia has a progressive personal income tax system in which the tax rate increases as an individual s income increases starting at 0 percent and capped at 30 percent. A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first rm5 000 to a maximum of 30 on chargeable income exceeding rm2 000 000 with effect from ya 2020. Malaysia personal income tax rates 2017 updates budget online income malaysia tax filing malaysia budget 2017 ta high earners more relief kpmg global individual income tax in malaysia for expatriates malaysia personal income tax guide 2017 irs.

Tax rates in malaysia. This page is also available in. Next rm15000 1 tax rate rm150 in taxes. 1 pay income tax via fpx services.

The fpx financial process exchange gateway allows you to pay your income tax online in malaysia. Technical or management service fees are only liable to tax if the services are rendered in malaysia while the 28 tax rate for non residents is a 3 increase from the previous year s 25. As the clock ticks for personal income tax deadline in malaysia 2018 like gainfully employed malaysians you may have started visiting the lhdn malaysia website to do your e filing as both a proactive and precautionary measure. Green technology educational services.

Next rm15000 10 tax rate rm1500 in taxes. A qualified knowledge worker in a specified area currently only iskandar malaysia is taxed at the concessionary rate of 15 on chargeable income from employment with a designated company engaged in a qualified activity e g. First of all you need an internet banking account with the fpx participating bank. This guide is for assessment year 2017 please visit our updated income tax guide for assessment year 2019.

Average lending rate bank negara malaysia schedule section 140b restriction on deductibility of interest section 140c income tax act 1967 study group on asian tax administration and research sgatar. No guide to income tax will be complete without a list of tax reliefs. 2017 at 1 12 am nice information about the tax system. To make the payment please go to byrhasil at https.

In malaysia for at least 182 days in a calendar year. With effect from ya 2020 a non resident individual is taxed at a flat rate of 30 on total taxable income. Pwc 2016 2017 malaysian tax booklet personal income tax tax residence status of individuals an individual is regarded as tax resident if he meets any of the following conditions i e. Next rm15850 10 tax rate rm3200.

In this example the person will have to pay a total tax of rm5600 for a total chargeable income of rm65850.