Public Mutual Private Retirement Scheme

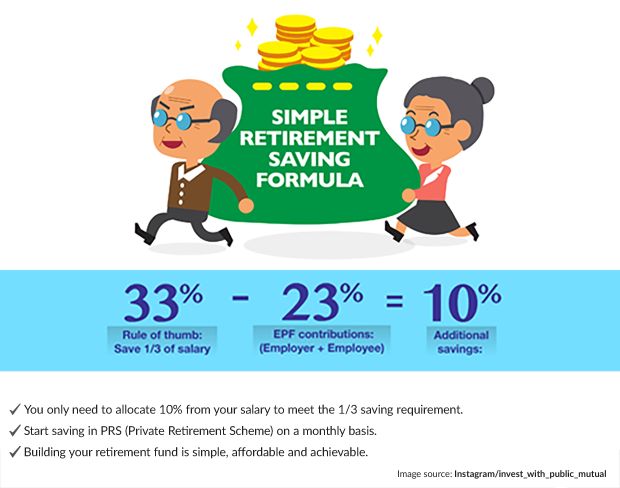

Private retirement scheme prs is a voluntary long term contribution scheme designed to help individuals accumulate savings for retirement.

Public mutual private retirement scheme. Prs seek to enhance choices available for all malaysians whether employed or self employed to supplement their retirement savings under a well structured and regulated environment. The contents in this website were prepared in good faith and the private pension administrator malaysia ppa expressly disclaims and accepts no liability whatsoever as to the accuracy relevance completeness or correctness of the information and opinion. A copy of the disclosure document and phs of public mutual private retirement scheme conventional series and public mutual private retirement scheme shariah based series can be viewed here. The prs is a defined contribution pension scheme which allows people to voluntarily contribute into an investment vehicle for the purposes of building up their retirement fund.

Private retirement schemes prs is a voluntary long term savings and investment scheme designed to help you save more for your retirement. This is especially useful for those who wish to grow their retirement fund and invest but aren t savvy in the area of investment. Public bank also distributes a wide range of prs funds that you may choose to contribute based on your contribution time horizon risk appetite and age. Public mutual is malaysia s largest private unit trust company with more than 160 unit trust funds under its management and is an approved private retirement scheme prs provider managing nine prs funds.

The private retirement scheme prs is a voluntary long term contribution scheme designed to help individuals accumulate savings for retirement. At public mutual we provide a wide range of prs funds that you may choose to contribute to based on your contributon time horizon risk appetite and age. Public mutual private retirement scheme shariah based series scheme trustee. Amanahraya trustees berhad public mutual prs islamic growth fund prs igrf please read the scheme s disclosure document before deciding to make a contribution.