Stamp Duty Malaysia 2017

The stamp duty for sale and purchase agreements and loan agreements are determined by the stamp act 1949 and finance act 2018 the latest stamp duty scale will apply to loan agreements dated 1 january 2019 or later and to sale and purchase agreements and.

Stamp duty malaysia 2017. In general term stamp duty will be imposed to legal commercial and financial instruments. The above exemption is applicable for sales and purchase agreement executed from 1 january 2017 to 31 december 2018 increase in stamp duty on instruments of. In malaysia for example the below is the current percentage applicable. Pengecualian duti setem untuk pembeli rumah pertama dibawah kempen pemilikan rumah gallery pengecualian duti setem untuk pembeli rumah pertama dibawah kempen pemilikan rumah latest article news purchase from developer stamp duty lawyer fees.

However stamp duty relief is available for the following circumstances subject to meeting the pre requisite. There are two types of stamp duty namely ad valorem duty and fixed duty. The transfer of shares will attract stamp duty at the rate of 0 3 on the consideration paid or market value of the shares whichever is the higher. However this exemption is limited to homes valued up to rm300 000 for first homebuyers only and for purchases between jan 1 2017 and dec 31 2018.

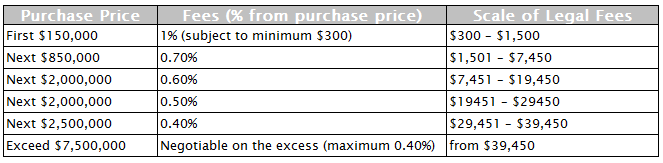

Stamp duty calculator malaysia 2017. Computation of stamp duty for transfer of real estate sample calculation for a rm500 000 property as per image on left first rm100. Prime minister datuk seri najib razak in tabling budget 2017 in parliament today said the current stamp duty exemption of 50 will be increased to 100. For sale and purchase agreement executed from 1 january 2017 to 31 december 2018.

Malaysia tenancy agreement stamp duty fee calculation april 7 2017 eddie 0 comments after getting your property paperwork sorted out and the daunting task of completing your renovation investment buyers will quickly seek to collect rental from the property. Stamp duty up to rm300 000 100 between rm300 001 and rm500 000 100 on the first rm300 000 and excess is subject to the prevailing rate of stamp duty. Legal fees for sale and purchase agreements and loan agreements are regulated by the solicitors remuneration amendment order 2017. For the purchase of first home priced exceeding rm300 000 up to rm500 000 stamp duty exemption is limited to rm300 000 of the value of home and the remaining balance of the value of the home is subject to the prevailing rate of stamp duty.

Nope this is not just in malaysia. Instruments liable to stamp duty are those listed in the first schedule of the stamp act 1949 exemptions relief from stamp duty general exemptions under section 35 in first schedule stamp act 1949 and specific exemptions under item 2 4 and 32 in first schedule stamp act 1949.