Submission Of Audited Account To Ssm 2020

You are required to submit annual return and audited financial statements audited accounts reports to ssm within one month from the date agm held.

Submission of audited account to ssm 2020. Sdn bhd s audit tax extended deadlines due to mco. She earlier explained that zahid had asked her to update yayasan akalbudi s documents because zahid knew the organisation never filed any agm and audit reports with the ssm since its founding. Under the same act a company is also required to submit its audit report to ssm within 30 days of its agm she added. It is learnt that ssm has been tightening its monitoring and enforcement by imposing severe penalty for late or non submission of annual returns and audited accounts.

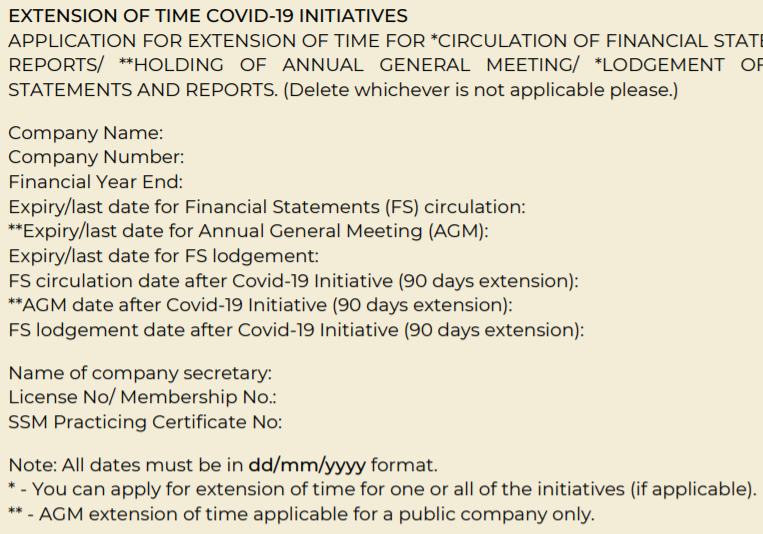

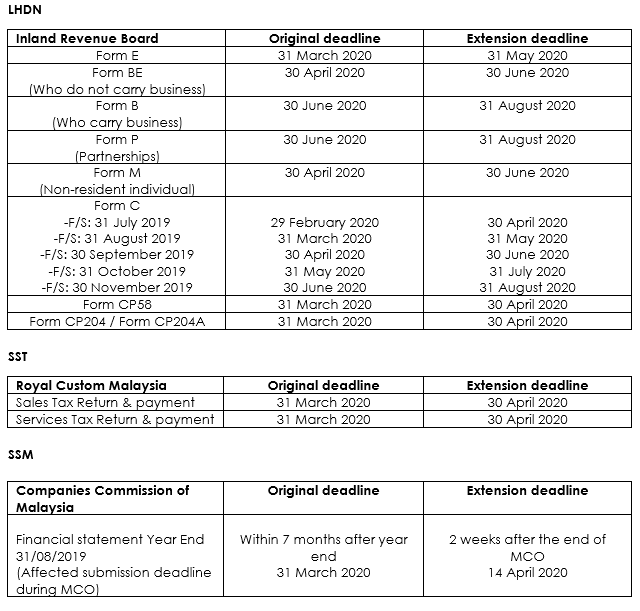

Key points in mia s letters to ssm bursa malaysia and the irb challenges faced by preparers and auditors of financial statements due to covid 19 especially on the audit of financial statements of entities for the year ended 31 december 2019 or the upcoming audits of other year ends. Filing to ssm 30 days mco extension of time need to apply ssm report lodgement deadline. 31 may 2020 submission 30 jun 2020 payment dl 02 monthly ttx 03 quarterly 31 mar 2020. Key changes are three 3 months grace period before this is 2 months from the due date of submission is allowed for those with accounting period ending 1 september 2019 until 31 december.

Such lodgement can be done via the mbrs portal or over the counter at any of ssm s offices nationwide. Ahmad zahid 67 faces 47 charges. 30 apr 2020 submission 30 jun 2020 payment dst 02. 30 apr 2020.

4 professional partners for a sdn bhd company thus you will need the following professional people to help you to meet the compliance requirements. 12 feb 2020 18 58 h. Please give us a call and let our specialized and professional team to handle it for you so you can leave your brain more space and concentrating for the growth of your business. Under the companies act a company must hold its agm not exceeding 15 months from the previous agm held and must submit its audit report to the ssm within 30 days after an agm has been convened.

Statutory body and submission. Payment of socso contribution and submission of form 8a the above is just a portion of many more deadlines for each and every businessman women to remember. Under the company law a director can be fined rm30 000 or jailed five years or both if he fails to lodge his company s annual return and audited accounts. Pd 6 2020 7 april 2020 revised 15 april 2020 fees for the application for extension of time 10.