Supply And Demand Graph With Tax Revenue

A price taker is one who sells output at a price fixed by the market forces of demand and supply.

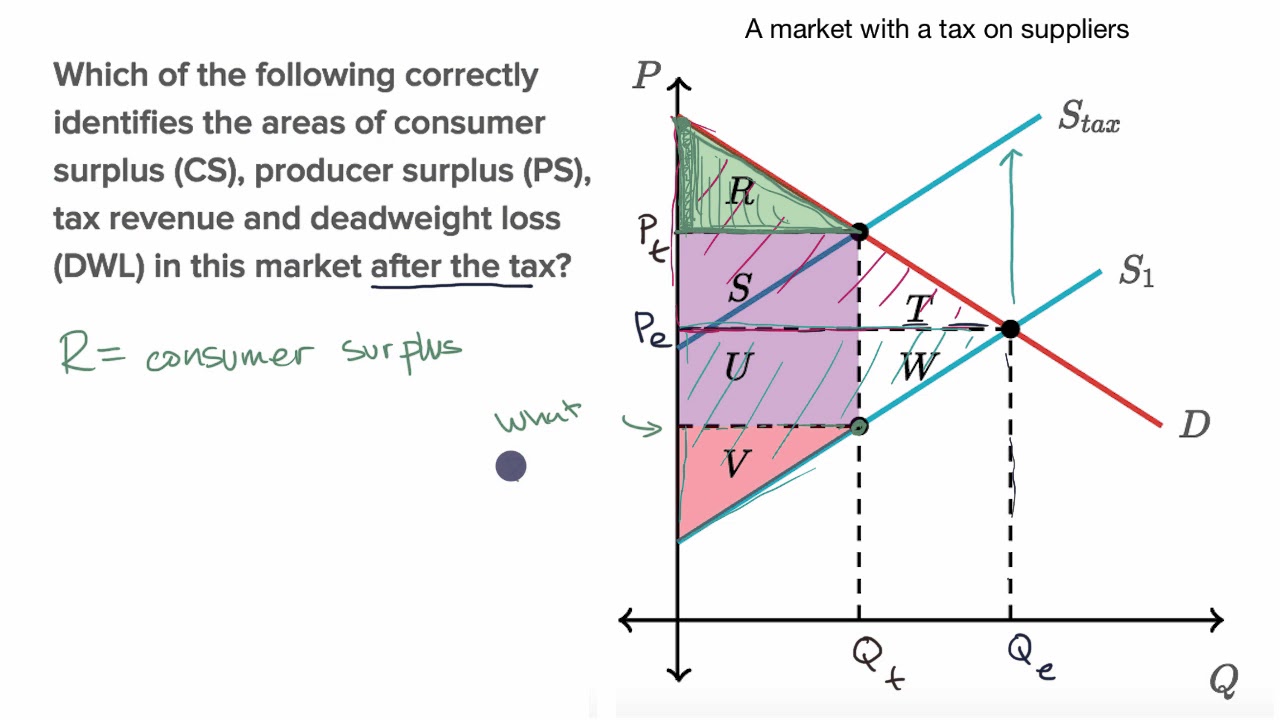

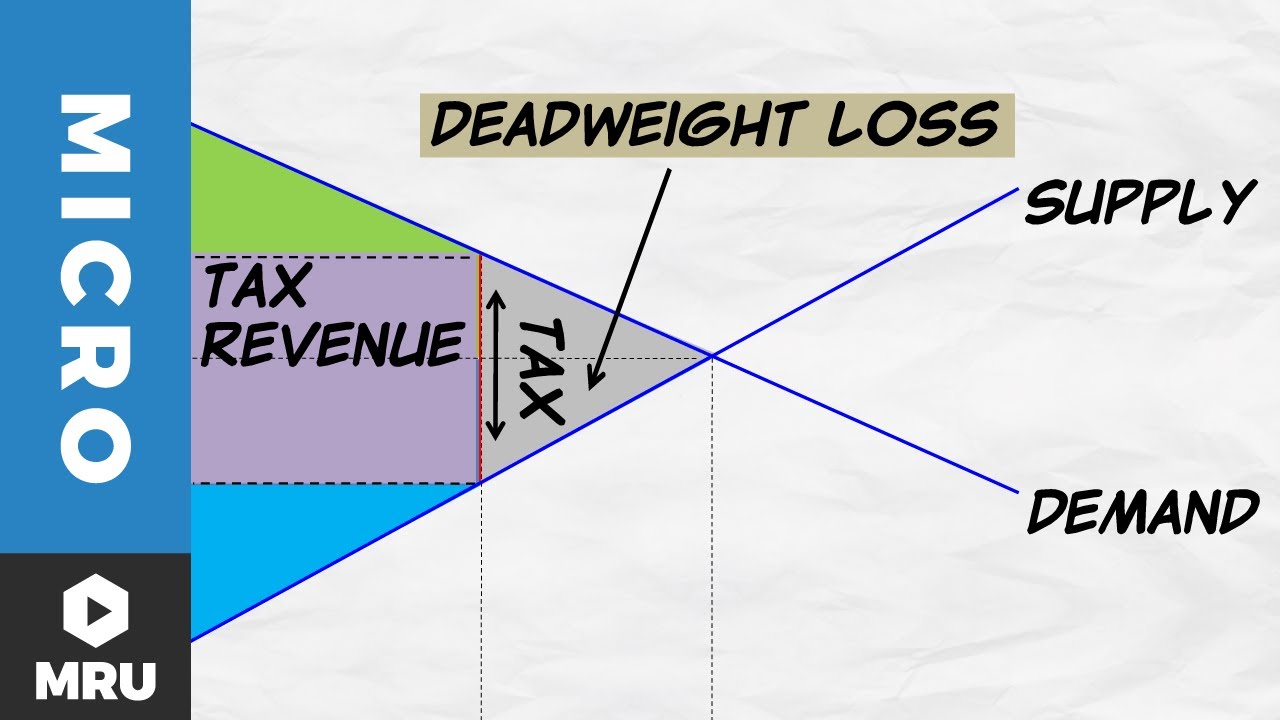

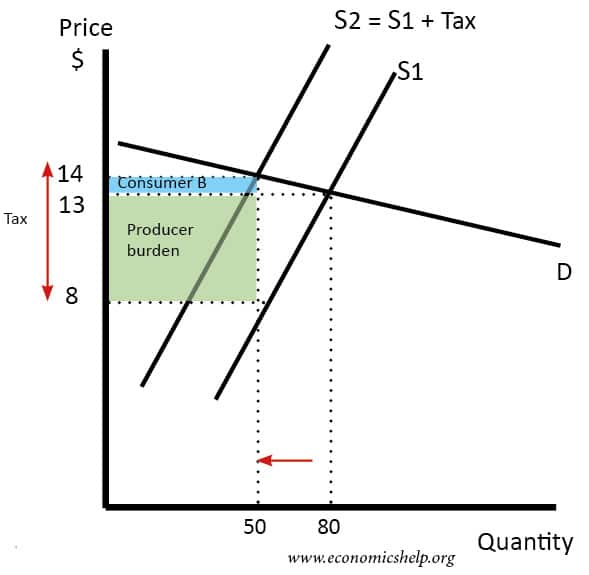

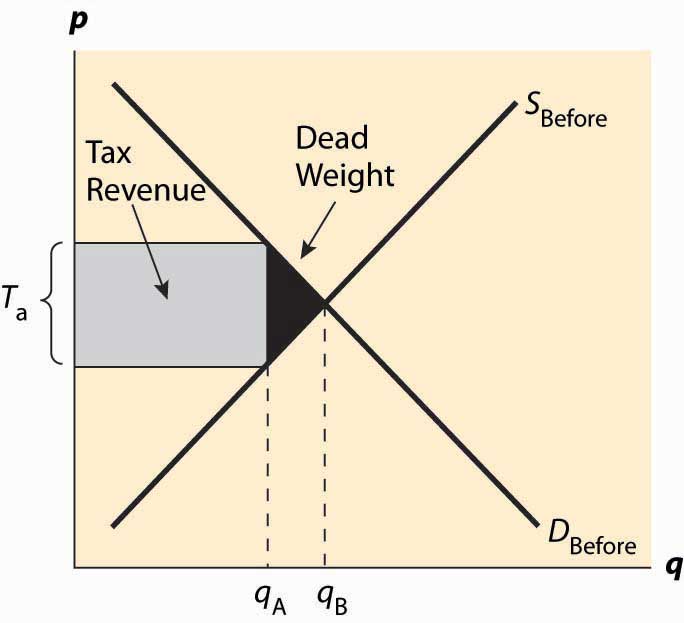

Supply and demand graph with tax revenue. Now please help me to calculate the amount of tax revenue and tax distribution. The sales tax on the consumer shifts the demand curve to the left symbolizing a reduction in demand for the product because of the higher price. Our lessons are m. The red line is the supply curve with taxes.

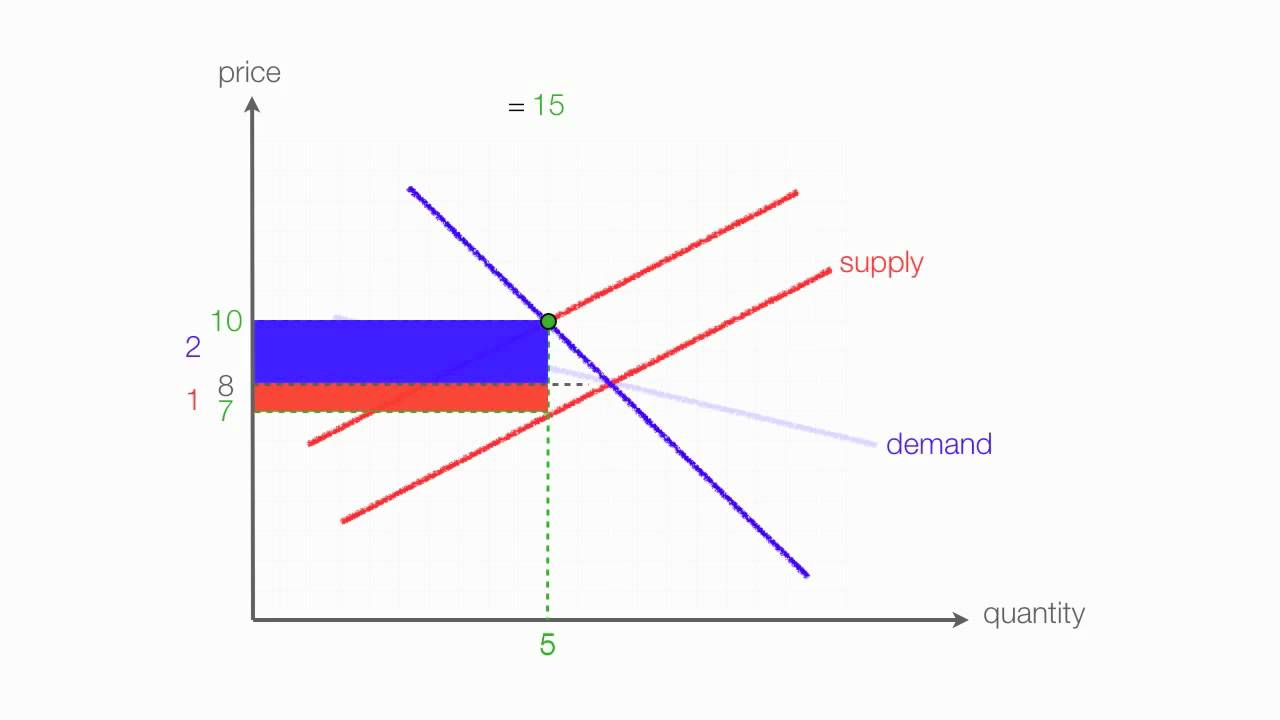

This is a very quick video about how to calculate revenue using the supply and demand curves. The blue line is the supply curve without taxes. Government s tax revenue is the area between the supply and demand curves above the horizontal axis and below the effective price to buyers. The grey area is the producer surplus.

It it not the value which maximizes the governments total tax revenue. Price multiplied by quantity at this point is equal to revenue. This is the imposed tax per gallon of gas. Write your answer at the bottom of the page and identify the specific color used to show total tax revenue.

This calculation is relatively easy if you already have the supply and demand curves for the firm. What ends up getting passed is a tax of 10 per vial. This video shows the mathematics behind the supply and demand model with taxes. While demand for the product has not changed all of the determinants of demand are the same consumers are required to pay a higher price which is why we see the new equilibrium point occurring at a higher price and lower quantity.

None of the above is correct. Now i get that after tax imposition the supply curve will move leftward hence the equilibrium price will increase and quantity demanded supply will decrease. So from the demand and supply functions we get 0 5q 200 0 5q q 200. The red area is the consumer surplus not complete in the picture.

So p 0 5 200 100. For a good that is taxed the area on the relevant supply and demand graph that represents government s tax revenue is a a. This video shows the mathematics behind the supply and demand model with taxes. The first part of the total tax revenue equation is 3 3 2 9.

The market price determined by the forces of demand and supply is rs 15 000 per tv set. If this video is a little fast we apologize. A firm s revenue is where its supply and demand curve intersect producing an equilibrium level of price and quantity. All the producers have to sell their product at this price.

A simple multiplication shows that the total revenue from the sale of 105 000 sets is rs 157 5 crore. The green line is the demand curve.