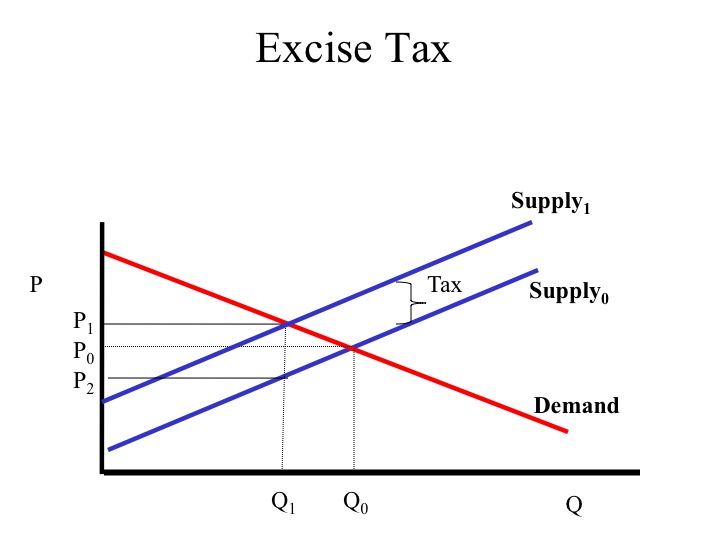

Supply And Demand Graph With Tax

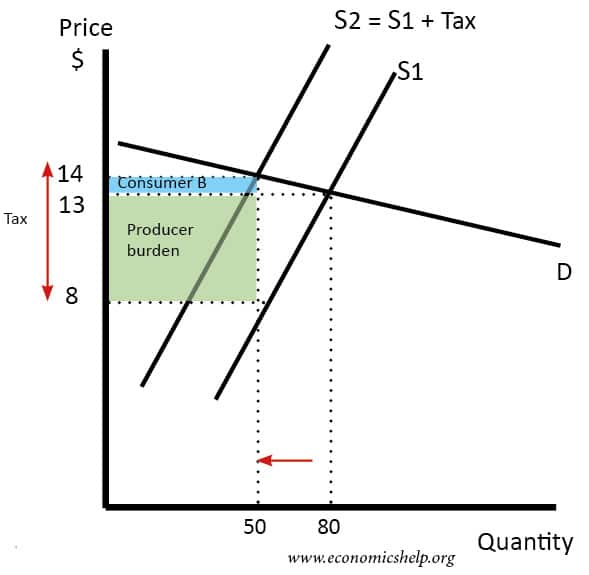

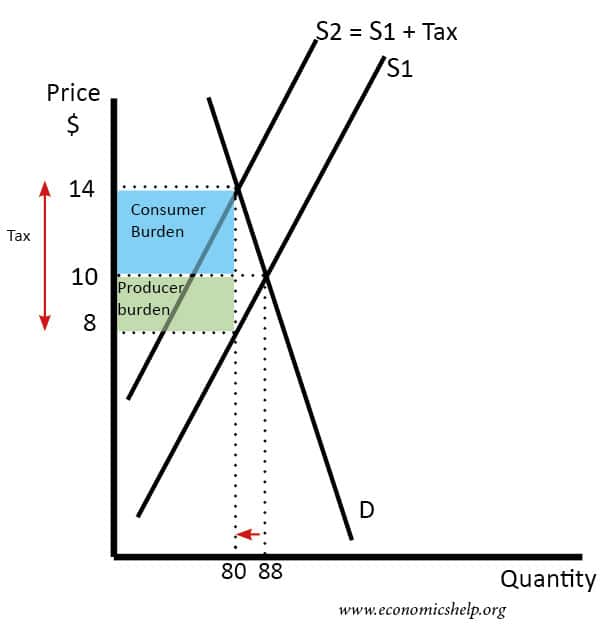

It is two different things to determine which curve will shift and who will actually bear the burden of the tax.

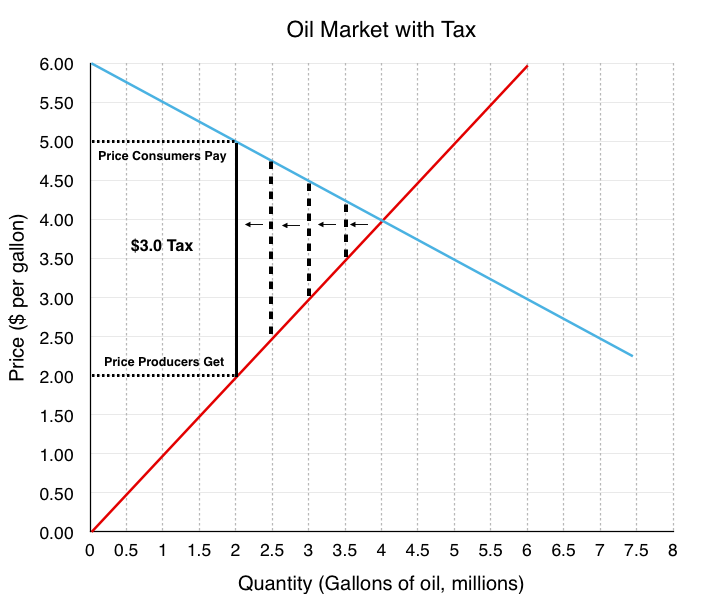

Supply and demand graph with tax. As stated by wecon the demand curve will shift down. Ap is owned by the college board which does not endorse this site or the above review. 1 show supply demand with an equilibrium price a. Your instructor asks you to determine p e and q e and plot the demand and supply curves if the government has imposed an indirect tax at a rate of 1 25 from each sold kilogram of potatoes.

To answer the later problem we need to look at price elasticity of supply and of demand. Marketparams tax rate number 0 demand. I m just making it instead of a percentage i m just doing it as a fixed amount so that we get kind of a fixed shift in terms of the perceived supply price. We ll think it through with our supply and our perfectly inelastic demand curve.

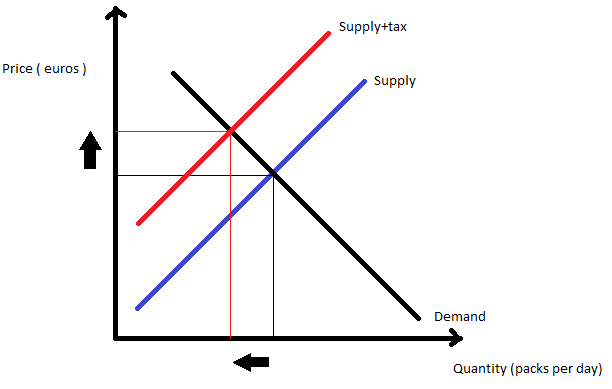

While demand for the product has not changed all of the determinants of demand are the same consumers are required to pay a higher price which is why we see the new equilibrium point occurring at a higher price and lower quantity. Marketparams price number 2 per unit.