Fixed Asset Write Off Tax Treatment Malaysia

Issues tax treatment 1.

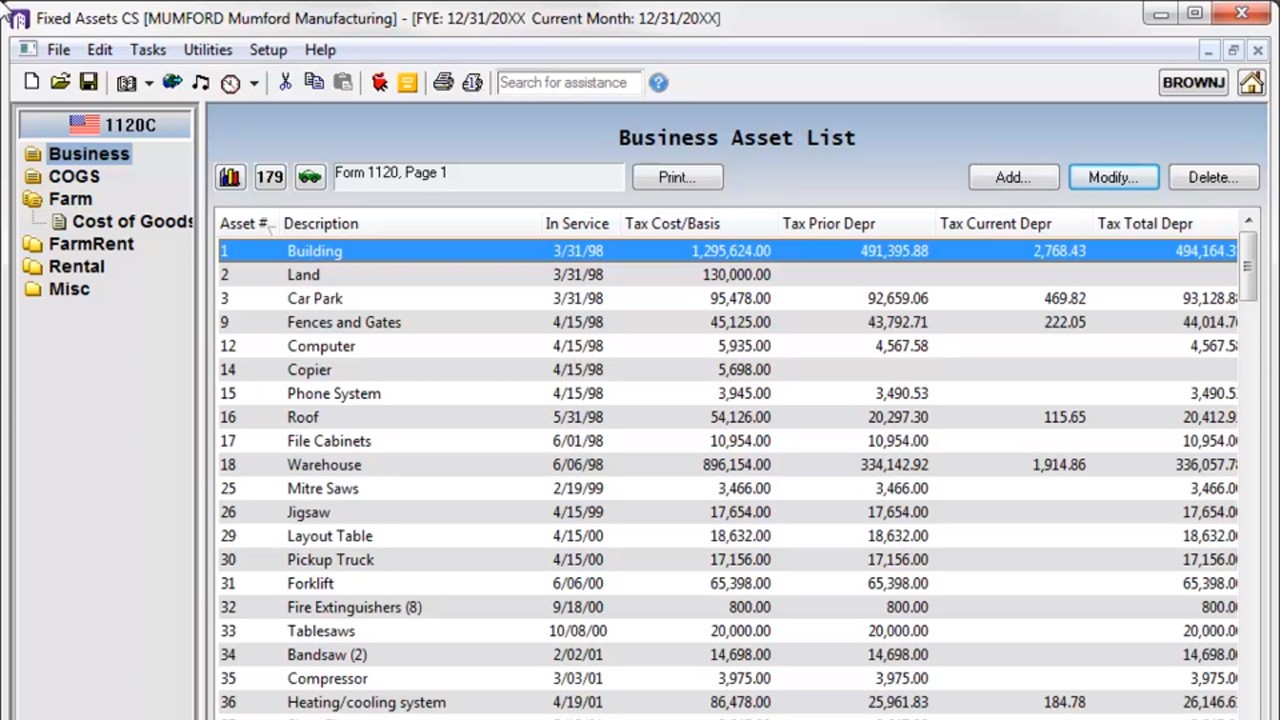

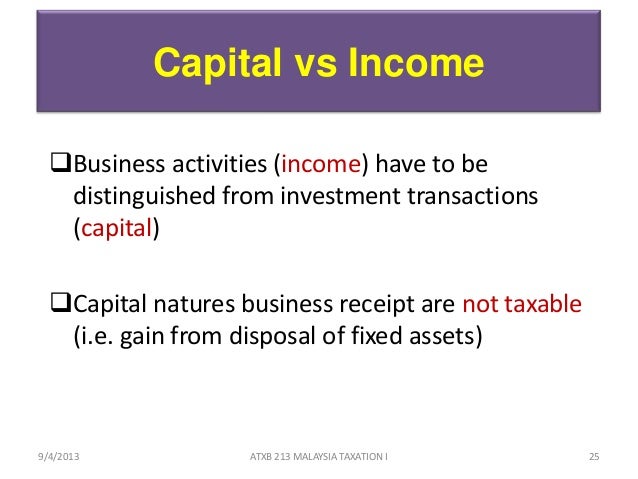

Fixed asset write off tax treatment malaysia. If the disposal value of a fixed asset exceeds the tax written down value the excess is known as a balancing charge the amount is restricted to the actual capital allowances claimed previously. Such tax treatment is accorded for an unlimited period of time. Issues tax treatment ii. 1 2 corporate tax malaysia operates a unitary tax system on a territorial basis.

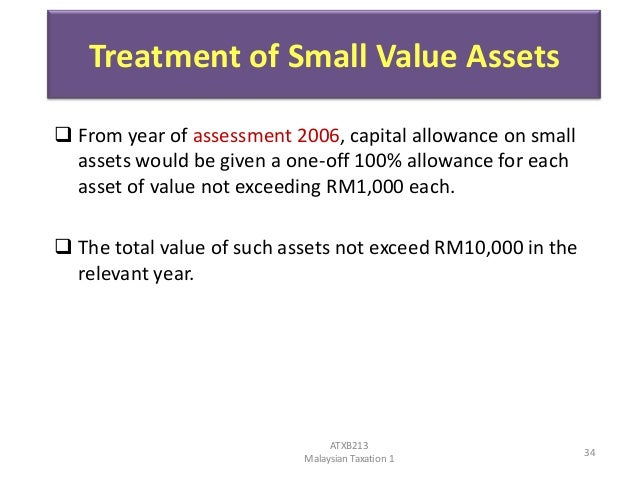

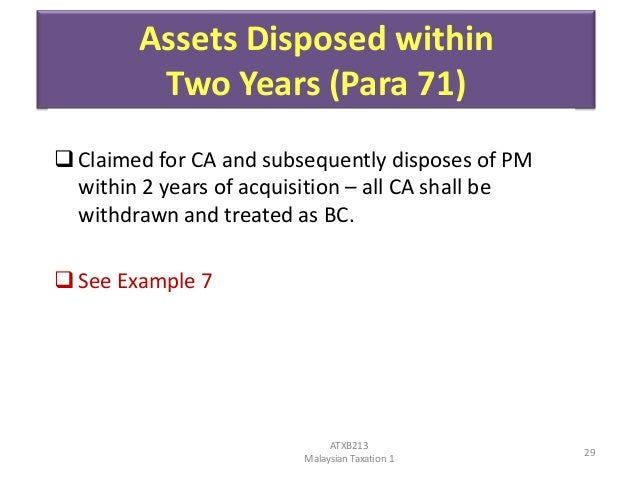

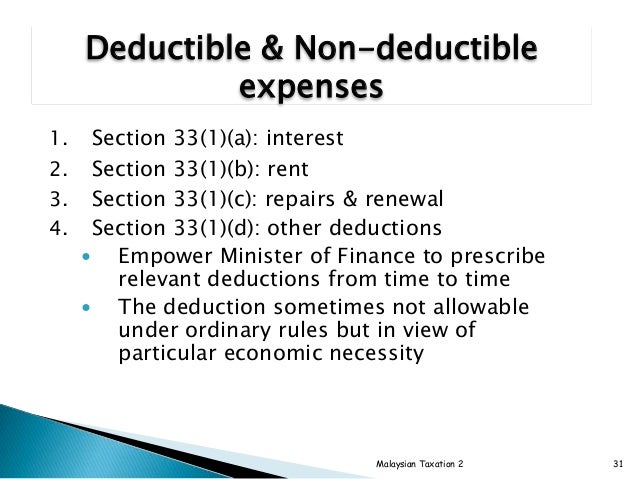

Capitalizations of interest expense subsection 33 1 a income tax act ita 1967 is applicable for the deduction of interest expense. The tax treatment for temporary disused asset falls under para 56 schedule 3 of ita 1967. Based on the criteria for classification for tax purposes an asset classified as hfs does not fall within. The write off of inventory will generate tax relief but only in the future when the goods are sold.

Ceased to be used not a non current asset held for sale. Companies are allowed to carry forward their accumulated tax losses and unutilised tax depreciation to be set off against their future business income. The objective of these guidelines is to explain the resulting income tax treatment arising from the adoption of the mfrs 123. Consequently a deferred tax asset of 25 x 1 000 250 as shown in table 8 should be recorded at the reporting date.

.jpg)

.jpg)

.jpg)